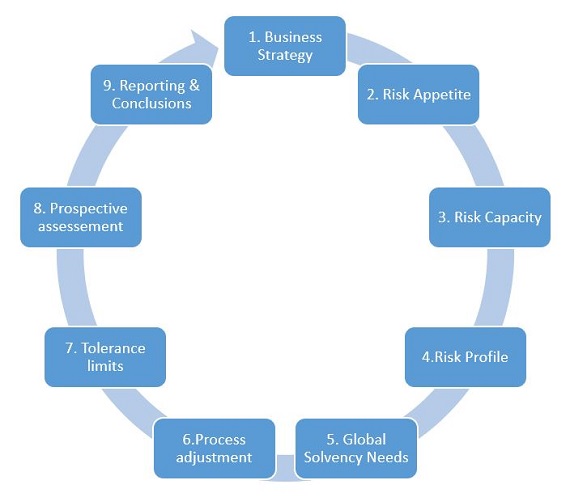

The « Solvency II Pillar 2 package » consists in a set of actuarial services fulfilling Own Risk Self Assessment (ORSA) requirements.

The objective of the ORSA process is to:

- Assess if the risks are properly identified and controlled

- Ensure a perfect match between the profile of the risks incurred, the captive’s capacity to absorb them and its appetite for risk

The captive must therefore be capable of delivering a prospective analysis of its own funds and demonstrate that it can mobilise the necessary capital in order to satisfy the need in capital – represented by the margin of solvency throughout the period of strategic planning.

We must therefore develop and research a large number of future scenarios (defined in function of the most significant risks), in order to scale the risk parameters and compare the different risk margins as well as the needs in terms of respective capital. We are then required to take recapitalisation measures or risk mitigation if necessary. We are able to conclude if the tolerance limits are exceeded and if measures must be taken.